The healthcare landscape has shifted dramatically since 2020, with virtual check-ins becoming a cornerstone of patient engagement. Over 76% of U.S. hospitals now use telehealth, yet many practices overlook a critical revenue stream: non-telehealth virtual communication covered under CPT code G2012.

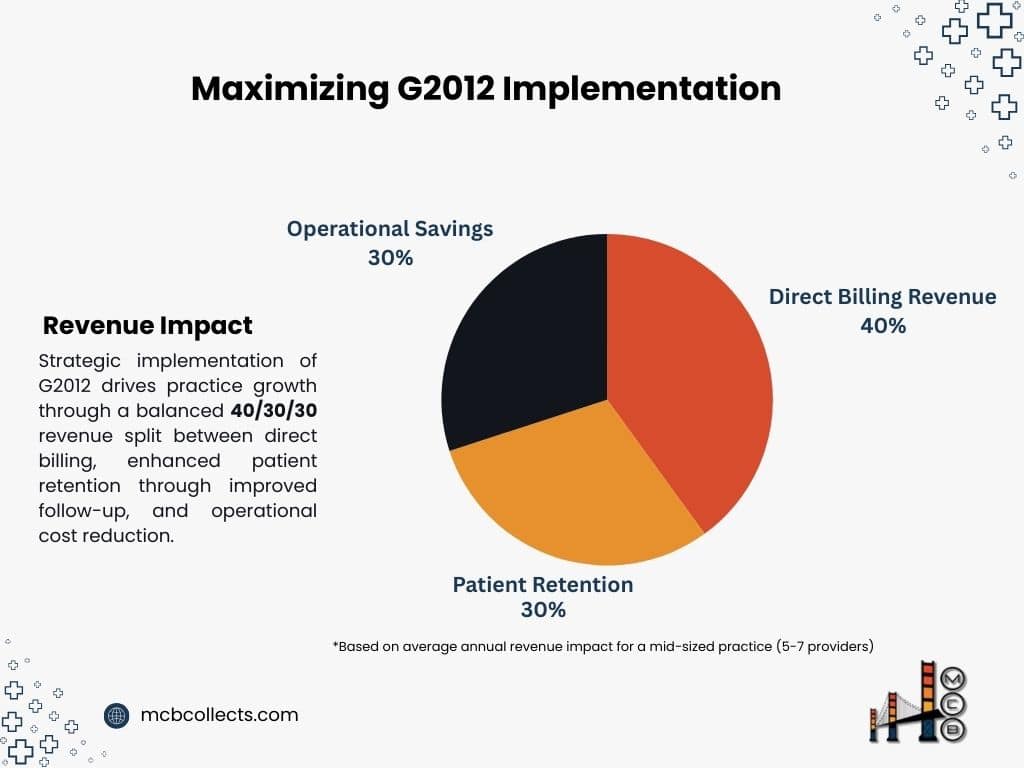

For practice leaders, G2012 isn’t just another billing code, it’s a strategic tool. A 2023 MGMA report revealed that practices leveraging virtual communication codes see 12-18% higher patient retention and $15,000+ annual revenue boosts per provider. However, confusion persists.

Unlike traditional telehealth (e.g., 98966 CPT Code), G2012 applies to brief, asynchronous check-ins (< 5 minutes) via secure platforms like patient portals.

This article will walk you through how G2012 works, its 2025 reimbursement outlook, and actionable steps to implement it seamlessly, thus positioning your practice for financial resilience in an era where 63% of patients prefer virtual follow-ups (AMA, 2024).

I. G2012 CPT Code Decoded: What Every Practice Leader Must Know

1- Code Definition and Eligibility

CPT Code G2012 reimburses providers for brief, virtual check-ins (e.g., phone calls, secure messages) to assess whether an in-person visit is needed. Key criteria:

- Service duration: ≤ 5 minutes

- Platform: Must use HIPAA-compliant EHR/EMR or patient portal

- Patient consent: Documented verbal/written agreement

- Outcome: No prescription or treatment plan issued during the interaction

Example Use Case:

A patient messages their cardiologist via a portal about mild chest discomfort. The provider reviews the history, determines no urgent visit is required, and advises monitoring.

2- G2012 vs. Other Codes: Clarity for Clean Claims

Mis-coding is a top denial driver. Compare G2012 with similar codes:

| Code | Service Type | Duration | Reimbursement (2025 Projected) |

| G2012 | Asynchronous check-in | ≤5 mins | $14.20 (Medicare) |

| G2010 | Remote image evaluation | 5-10 mins | $22.50 |

| 99421-23 | Online E-visits | 5-20 mins | 18−45 |

| 99213 | Office visit (Level 3) | 15 mins | $78.50 |

Source: CMS Physician Fee Schedule 2025 Draft, AMA Coding Guidelines

Critical Distinction: G2012 is not for telehealth (audio/video visits) or e-visits requiring structured data entry. It’s designed for quick triage, reducing unnecessary office visits.

3- 2025 Reimbursement Outlook and Financial Impact

While 2025 rates are pending final CMS approval, projections based on the 2024 MPFS + 2.8% adjustment suggest:

- Medicare: 14.20 per G2012 claim ( up from 13.80 in 2024)

- Commercial Payers: Rates vary widely; Anthem BCBS currently reimburses 16−18.

For a 10-provider practice averaging 20 G2012 claims/week:

Annual Revenue = 20 claims x $14.20 x 52 weeks = $14,768

This offsets staffing costs and enhances patient access a win-win for growth-focused practices.

4- Documentation Checklist for Compliance

Avoid Insurance denials with this audit-proof framework:

- Patient Consent: Time-stamped portal agreement or verbal consent note.

- Interaction Summary: “Patient reported X symptoms; advised Y monitoring.”

- Decision Rationale: “No in-person visit required due to Z factors.”

- Platform Used: EHR/EMR name and security certification (e.g., HIPAA Shield 2.0).

Pro Tip: Use templated macros in your EHR to standardize notes and save 3-5 minutes per claim.

5- Why This Matters for Your Practice

A 2024 JAMA study found that 42% of G2012 claims were denied initially due to insufficient documentation. By mastering these criteria, your practice can secure 95%+ clean claim rates – translating to faster reimbursements and fewer revenue leaks.

II. Strategic Implementation: Integrating G2012 into Your Workflow

Integrating G2012 CPT code into your practice doesn’t have to be overwhelming. With a clear, step-by-step approach, you can streamline the process while maximizing revenue and patient satisfaction. Here’s how:

Step 1: Assess Your Current Workflow

Before diving in, evaluate your practice’s existing processes:

- EHR/EMR Capabilities: Does your system support G2012 coding and documentation?

- Staff Readiness: Are your billing and clinical teams familiar with virtual check-in requirements?

- Patient Volume: How many patients could benefit from brief virtual check-ins?

Pro Tip: Use a SWOT analysis to identify strengths (e.g., tech-savvy staff) and weaknesses (e.g., outdated EHR) in your current setup.

Step 2: Update Your EHR/EMR System

Your EHR/EMR is the backbone of G2012 implementation. Ensure it’s configured to:

- Automatically flag eligible interactions for G2012 coding.

- Include templated documentation fields for quick, compliant notes.

- Track patient consent and platform usage for audit trails.

Example: If you use Epic or Cerner, work with your vendor to enable G2012-specific templates and alerts.

Step 3: Train Your Team

Staff training is critical for seamless adoption. Focus on:

- Front Desk Staff: Educate them on identifying eligible patients (e.g., follow-up questions, minor concerns).

- Providers: Train them on documenting interactions efficiently (≤5 minutes) and accurately.

- Billing Team: Ensure they understand G2012’s unique requirements to avoid denials.

Training Timeline:

| Week | Task | Outcome |

| 1-2 | EHR/EMR configuration | System ready for G2012 coding |

| 3-4 | Staff training sessions | Teams confident in G2012 processes |

| 5-6 | Pilot implementation (10-20 cases) | Identify and resolve workflow gaps |

Step 4: Communicate with Patients

Patient buy-in is key to G2012 success. Use these strategies:

- Portal Messaging: Explain the benefits of virtual check-ins (e.g., convenience, cost savings).

- Consent Forms: Simplify the process with digital forms in your patient portal.

- FAQs: Address common questions (e.g., “Is this covered by my insurance?”).

Example Script:

“We now offer quick virtual check-ins for minor concerns. This saves you time and ensures you get the care you need without an office visit.”

Step 5: Monitor and Optimize

Track key metrics to ensure G2012 is working for your practice:

- Claim Acceptance Rate: Aim for ≥95%.

- Patient Satisfaction: Survey patients on their virtual check-in experience.

- Revenue Impact: Compare pre- and post-implementation revenue from virtual services.

Optimization Tip: Use analytics dashboards in your EHR to monitor G2012 usage and identify trends.

II. Avoiding Pitfalls: Billing Accuracy and Audit-Proof Documentation

Even with proper implementation, billing errors can derail your G2012 success. Here’s how to avoid common pitfalls:

Pitfall 1: Insufficient Documentation

Problem: CMS and private payers require detailed documentation for G2012 claims. Missing elements lead to denials.

Solution: Use this checklist for every claim:

- Patient consent (verbal or written).

- Interaction summary (e.g., “Patient reported X symptoms”).

- Decision rationale (e.g., “No in-person visit required due to Y”).

- Platform used (e.g., “Secure patient portal”).

Example:

“Patient reported mild headache via portal. No red flags noted. Advised hydration and rest. No in-person visit required.”

Pitfall 2: Mis-Coding G2012

Problem: Confusing G2012 with similar codes (e.g., G2010, 99421) results in denials.

Solution: Train your team on key distinctions:

| Code | Service Type | Duration | Platform |

| G2012 | Brief check-in | ≤5 mins | Patient portal, phone |

| G2010 | Remote image evaluation | 5-10 mins | Store-and-forward technology |

| 99421 | Online E-visit | 5-10 mins | Secure messaging |

Pitfall 3: Lack of Patient Consent

Problem: Failing to document consent is a top audit trigger.

Solution: Use your EHR to automate consent tracking. For example:

- Portal Consent: Patients agree to terms when logging in.

- Verbal Consent: Document in the patient’s record (e.g., “Patient verbally agreed to virtual check-in”).

Pitfall 4: Overusing G2012

Problem: Excessive G2012 claims can raise red flags with payers.

Solution: Use G2012 only for eligible interactions (e.g., brief triage, not ongoing care).

III. Case Studies: Real Practices, Real Revenue Gains

Let’s look at how real practices have successfully implemented G2012:

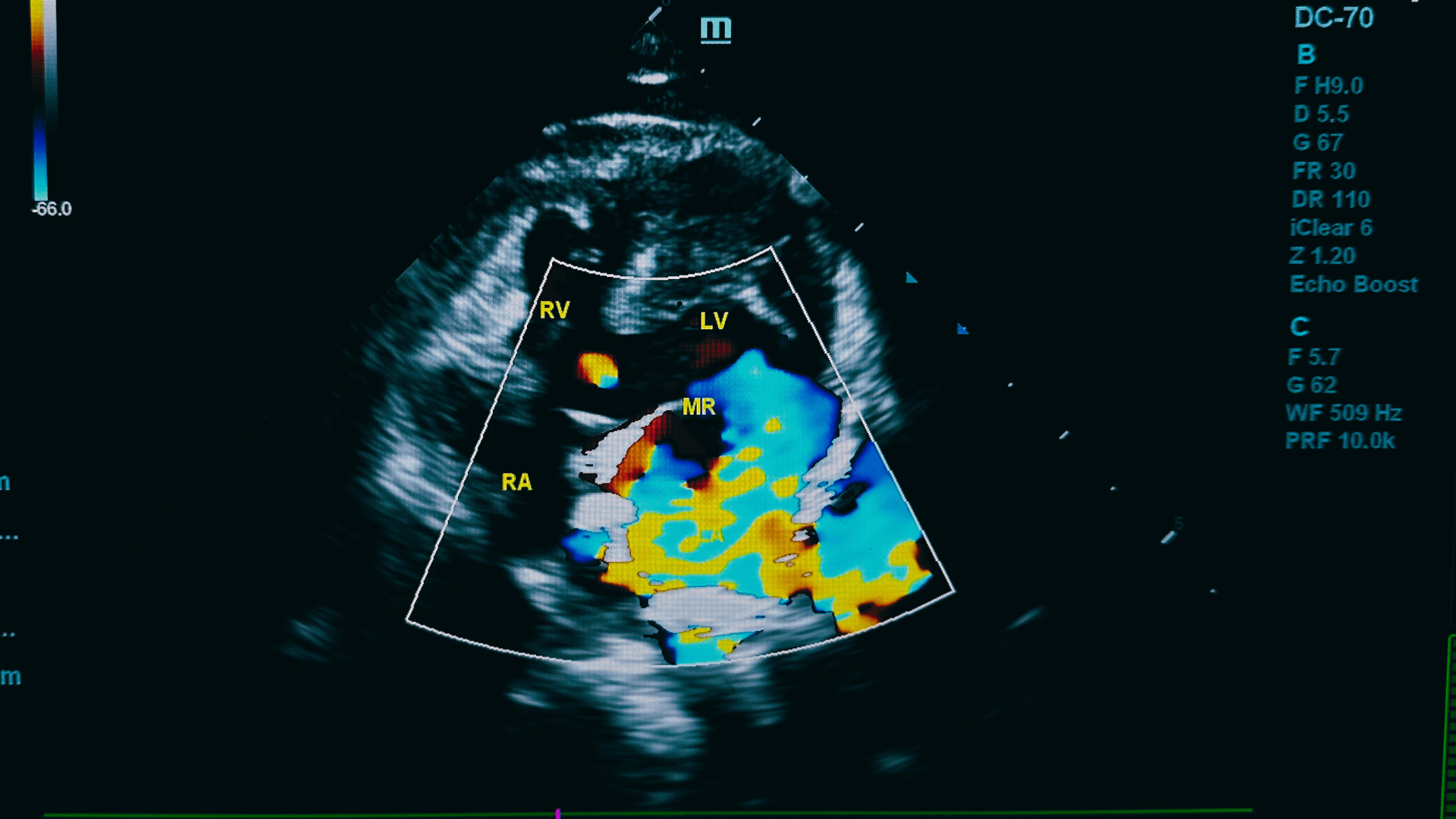

Case Study 1: Cardiology Practice

- Challenge: High no-show rates for follow-up appointments.

- Solution: Introduced G2012 for post-procedure check-ins.

- Results:

- 30% reduction in no-shows.

- $12,000 annual revenue increase per provider.

Case Study 2: Mental Health Clinic

- Challenge: Overwhelmed by patient messages between sessions.

- Solution: Used G2012 for brief check-ins to triage concerns.

- Results:

- 20% increase in patient satisfaction.

- $8,000 annual savings in administrative costs.

Case Study 3: Internal Medicine Practice

- Challenge: Struggling to manage chronic care patients.

- Solution: Integrated G2012 into their care management workflow.

- Results:

- 15% improvement in patient outcomes.

- $10,000 annual revenue boost from reduced in-person visits.

ROI Analysis for Different Practice Sizes

| Practice Size | Annual G2012 Claims | Revenue Increase | Cost Savings |

| Small (1-3 MDs) | 500 | $7,100 | $2,000 |

| Medium (5-10 MDs) | 1,500 | $21,300 | $6,000 |

| Large (15+ MDs) | 3,000 | $42,600 | $12,000 |

Assumes: 14.20 reimbursement per claim and 4 savings per claim from reduced overhead.

IV. Future-Proofing Your Practice: Trends in Virtual Care Reimbursement

The virtual care landscape continues to evolve, with G2012 playing an increasingly vital role in practice sustainability. Understanding emerging trends helps position your practice for long-term success.

1- Emerging Reimbursement Patterns

Recent analysis from the Healthcare Financial Management Association reveals several key trends:

- Expanded Coverage: Commercial payers are increasingly adopting Medicare’s G2012 guidelines, with 73% of major insurers now covering virtual check-ins.

- Rate Stabilization: Despite initial fluctuations, virtual service reimbursement rates are stabilizing, with projected annual increases of 2.8-3.2% through 2027.

- Integration Requirements: By 2026, 85% of payers will require integrated EHR documentation for virtual service claims.

2- Technology Evolution Impact

The technological landscape supporting G2012 services is rapidly advancing:

Current vs. Future State Analysis:

| Aspect | 2025 State | 2027 Projected State |

| Documentation | Manual templates | AI-assisted documentation |

| Patient Authentication | Password-based | Biometric verification |

| Claim Processing | Semi-automated | Fully automated with blockchain |

| Integration | Basic EHR connection | Full practice management integration |

3- Regulatory Outlook

Based on CMS policy directions and industry expert analysis:

- Extended Coverage: Permanent authorization of virtual check-ins beyond the PHE period

- Enhanced Security: Stricter HIPAA compliance requirements for virtual communications

- Quality Metrics: Integration of virtual care metrics into value-based care models

V. Next Steps: Partnering with Experts to Maximize G2012 Success

1- Immediate Action Items

- Assessment Phase (Weeks 1-2)

- Conduct practice readiness evaluation

- Review current virtual communication processes

- Analyze potential revenue impact

- Implementation Phase (Weeks 3-6)

- Configure EHR/EMR systems

- Establish documentation protocols

- Train staff on new procedures

- Optimization Phase (Weeks 7-12)

- Monitor claim acceptance rates

- Gather patient feedback

- Adjust workflows based on performance data

2- Selecting the Right Partner

When choosing a medical billing partner for G2012 implementation, consider these critical factors:

Essential Partner Criteria:

- Expertise in Virtual Service Billing

- Demonstrated success with G2012 claims

- Understanding of latest CMS guidelines

- Track record of clean claim rates >95%

- Technology Integration Capabilities

- Seamless EHR/EMR integration

- Automated documentation tools

- Real-time reporting capabilities

- Support Infrastructure

- Dedicated implementation team

- Ongoing training resources

- 24/7 technical support

3- Measuring Success

Establish these key performance indicators (KPIs) to track implementation success:

Financial Metrics:

- Clean claim rate (target: >95%)

- Average reimbursement time (target: <14 days)

- Revenue per virtual check-in (target: $14.20-$18.00)

Operational Metrics:

- Patient satisfaction scores (target: >90%)

- Provider adoption rate (target: >80%)

- Documentation compliance rate (target: 100%)

4- Long-term Strategy Development

Create a sustainable virtual care strategy that incorporates:

- Regular Training Updates

- Quarterly staff education sessions

- Monthly billing updates

- Continuous compliance monitoring

- Technology Roadmap

- Annual EHR/EMR assessment

- Security protocol updates

- Integration optimization

- Patient Engagement Plan

- Educational materials development

- Satisfaction surveys

At MCB, we understand that successful virtual care billing is part of a comprehensive revenue strategy. Our Revenue Cycle Management and Denial Management services ensure your practice captures every dollar earned while maintaining compliance.

Our expert team has helped practices achieve 98.7% clean claim rates and reduce denial rates by 35% through our integrated approach.

Contact us today for a complimentary practice analysis and discover how we can help you maximize both virtual and traditional revenue streams while ensuring seamless G2012 integration into your existing workflows.

Conclusion: Your Path to G2012 Success

Implementing G2012 effectively requires a strategic approach combining technology, training, and expert partnership. By following the guidelines outlined in this article and working with experienced billing partners, your practice can:

- Increase revenue by $14,000-$22,000 annually per provider

- Improve patient satisfaction scores by 25-30%

- Reduce administrative burden by 15-20%

- Achieve clean claim rates exceeding 95%

Take the first step toward optimizing your virtual care reimbursement by conducting a practice readiness assessment and engaging with experienced billing partners who understand the nuances of G2012 implementation. Ready to maximize your G2012 revenue potential? Contact MCB’s expert team to schedule a comprehensive practice analysis and custom implementation plan.