Article Summary:

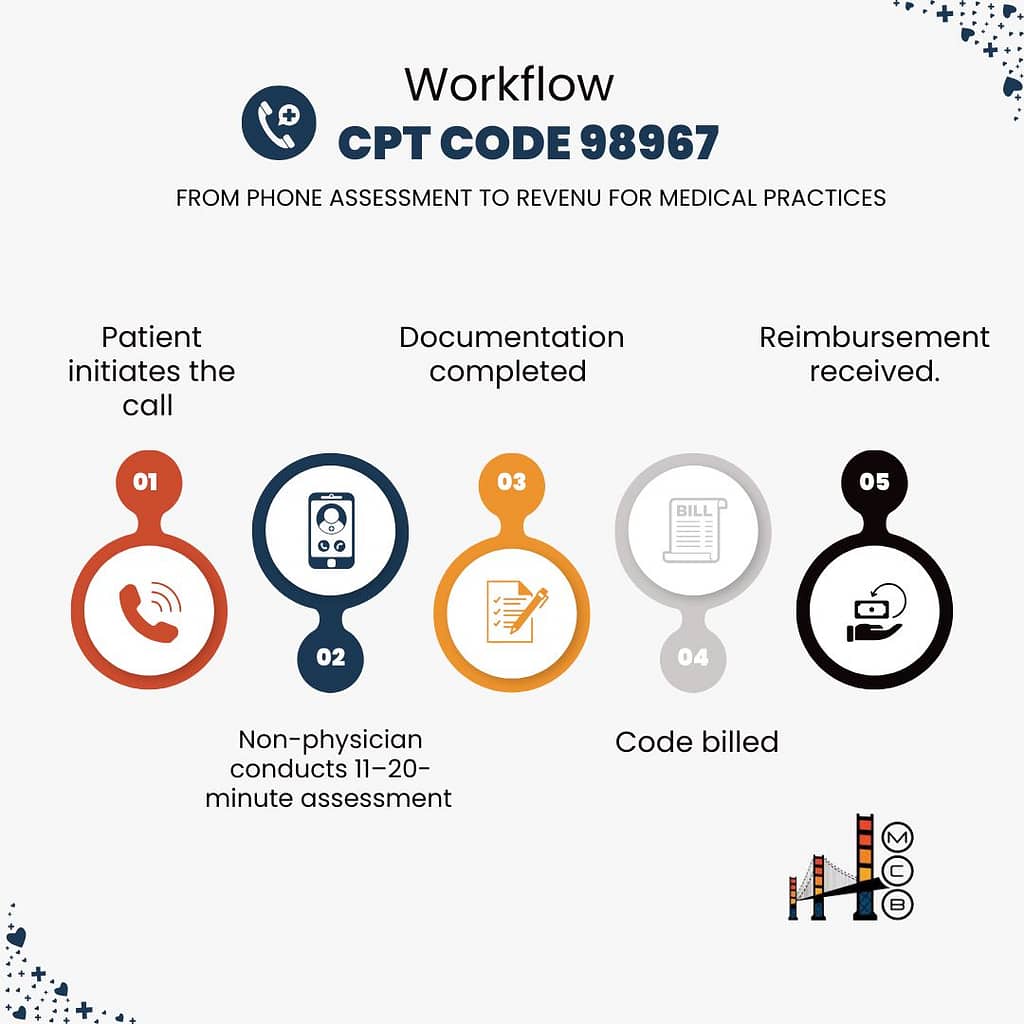

For medical administrators managing telehealth services, 98967 CPT code covers intermediate-length telephone assessments lasting 11-20 minutes by non-physician healthcare professionals. With an average reimbursement ranging from $27 to $49, proper implementation can add significant revenue to your practice.

💡 Practices implementing this code effectively report annual revenue increases of $54,720 or more.

Introduction

Telehealth billing continues to evolve, and capturing revenue from telephone assessments has become crucial for practice sustainability. 98967 CPT Code represents a key opportunity to optimize your revenue cycle while ensuring compliant billing for services your clinical staff already provides.

1. Breaking Down CPT Code 98967

Medical billing complexity increases with telehealth services. Before diving into specific requirements, medical administrators need to understand how 98967 CPT code fits into their revenue cycle.

This intermediate-length phone assessment code serves as a bridge between brief check-ins and complex consultations, offering significant revenue potential when properly documented and billed.

Understanding the specific requirements of 98967 CPT code helps prevent denied claims and optimize reimbursement. This code has distinct components that your billing staff must verify before submission:

| Component | Requirement | Administrative Notes |

| Time Range | 11-20 minutes | Must be continuous time |

| Provider Type | Non-physician | Credentials must be verified |

| Patient Type | Established only | Verify status before billing |

| Initiation | Patient-initiated | Document who initiated contact |

| Documentation | Full assessment | Use structured templates |

2. Code Comparison and Selection: CPT 98967 vs. Related Telehealth Codes

Selecting the right billing code directly impacts your practice’s revenue. While 98967 CPT code covers intermediate-length calls, it exists within a family of related codes.

Understanding these relationships helps prevent coding errors and optimizes reimbursement opportunities across different service lengths and provider types.

Medical administrators need to understand how 98967 fits into the broader telehealth coding landscape. Here’s how this code compares to related services:

| Code | Duration | Provider Level | 2025 Rates* | Best Use Case |

| 98967 | 11-20 min | Non-physician | $27-$49 | Standard telephone assessment |

| 98966 | 5-10 min | Non-physician | $14-$25 | Brief check-ins |

| 98968 | 21-30 min | Non-physician | $41-$73 | Complex cases |

| 99442 | 11-20 min | Physician | $90-$110 | MD/DO assessments |

| G2012 | 5-10 min | Any qualified | $15-$30 | Virtual check-ins |

*⚠️Rates vary by location and payer. Verify current rates for your area.

3. Documentation Requirements

Documentation serves as the foundation for clean claims and audit protection. Every telephone assessment under CPT 98967 requires specific elements to support medical necessity and justify reimbursement. Proper documentation not only ensures payment but also protects your practice during audits.

Proper documentation directly impacts reimbursement success. Here’s your essential documentation framework:

| Required Element | Details | Verification Method |

| Time Documentation | • Start/end times• Clinical discussion duration• Total encounter time | EHR timestamps |

| Patient Information | • Consent for telehealth• Reason for contact• Current symptoms | Patient record |

| Clinical Assessment | • Findings• Changes from previous• Current status | Progress notes |

| Plan of Care | • Recommendations• Follow-up needed• Resources provided | Care plan |

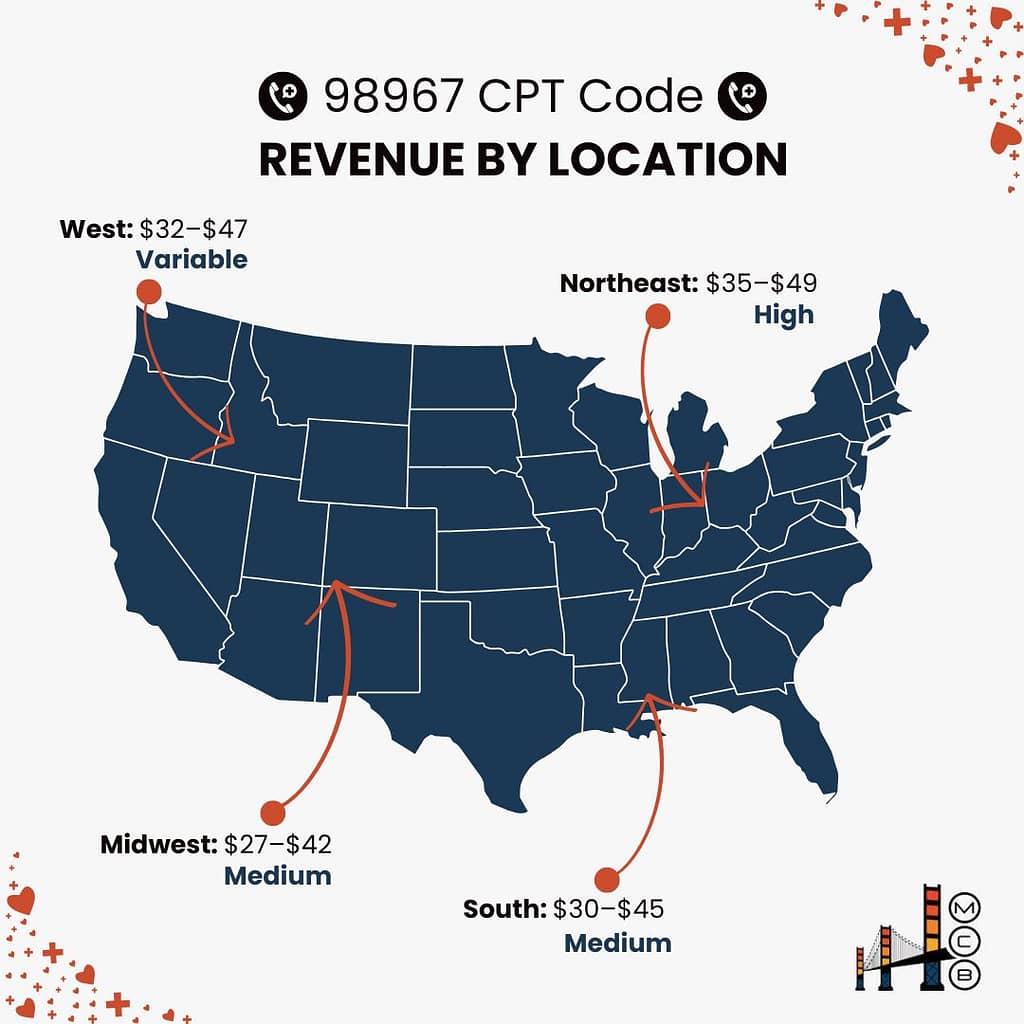

4. Revenue Optimization Across Regions

Geographic location significantly impacts reimbursement rates for telehealth services. Understanding these regional variations helps you set realistic revenue goals and identify opportunities for optimization. Each region presents unique challenges and opportunities for maximizing your 98967 reimbursement.

Regional reimbursement variations create opportunities for revenue optimization. Here’s what to expect across different areas:

| Region | Rate Range | Key Factors |

| Northeast | $35-$49 | Higher operating costs |

| Midwest | $27-$42 | Standard market rates |

| South | $30-$45 | Competitive market |

| West | $32-$47 | Variable by state |

5. Building a Compliance Framework

Compliance isn’t just about following rules; it’s about creating sustainable revenue streams. A robust compliance program for CPT 98967 billing protects your practice while ensuring maximum legitimate reimbursement. This dual approach safeguards both your revenue and your reputation.

Managing compliance requires systematic oversight. Here’s your compliance framework:

| Area | Requirements | Monitoring Method |

| Provider Credentials | • Current license• Required certifications | Monthly verification |

| Time Tracking | • Accurate logs• Service duration | Daily audits |

| Patient Eligibility | • Insurance status• Service frequency | Pre-service check |

6. Implementation Strategy

Implementing new billing processes requires careful planning and execution. A structured approach to CPT 98967 implementation ensures staff buy-in, minimizes disruption, and accelerates time to revenue. This phase-based strategy helps practices avoid common pitfalls while optimizing results.

Successfully implementing 98967 billing requires a structured approach:

| Phase | Actions | Timeline |

| Planning | • Staff training• EHR setup • Template creation | Week 1-2 |

| Testing | • Trial period• Process refinement• Staff feedback | Week 3-4 |

| Full Launch | • Go-live• Monitoring• Adjustments | Week 5+ |

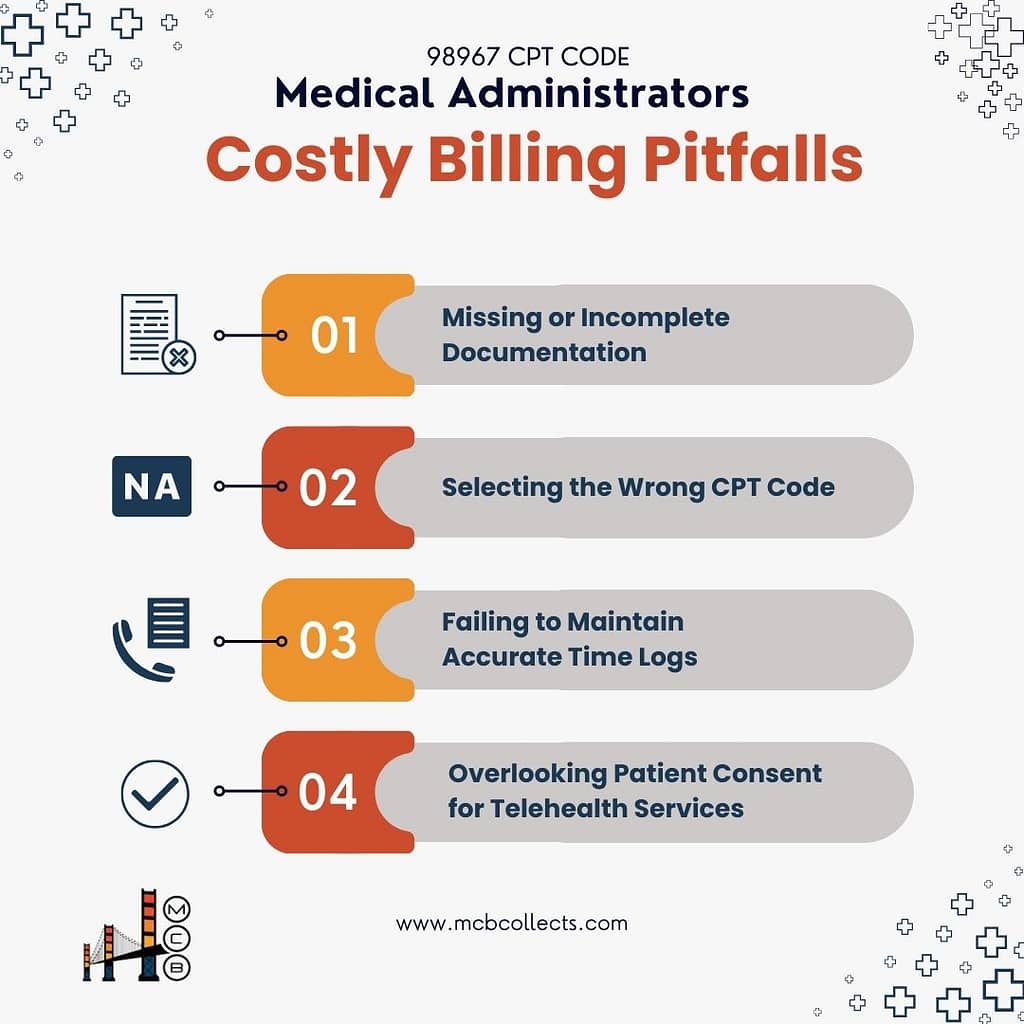

7. Common Challenges and Solutions

Every practice faces obstacles when billing telephone assessments. Understanding common challenges with CPT 98967 billing helps you prevent problems before they impact revenue. These proven solutions address the most frequent issues administrators encounter.

Here are the most frequent issues administrators face with 98967 billing:

| Challenge | Impact | Solution |

| Incomplete Documentation | Denied claims | Structured templates |

| Time Tracking Errors | Underpayment | Automated systems |

| Wrong Code Selection | Revenue loss | Staff education |

| Missing Consent | Compliance risk | Pre-call checklist |

8. Technology Integration: Leverage EHR for Maximum Efficiency

Your practice management system plays a crucial role in CPT 98967 billing success. Modern technology solutions streamline documentation, prevent errors, and accelerate reimbursement. Proper system configuration ensures consistent, compliant billing processes.

Your practice management system should support these key functions:

| Function | Purpose | Benefit |

| Time Tracking | Accurate service duration | Clean claims |

| Templates | Standardized documentation | Compliance |

| Alerts | Same-day service checks | Prevent denials |

| Reports | Revenue monitoring | Optimization |

9. Financial Performance Metrics

Tracking specific metrics helps you evaluate your CPT 98967 billing performance. Understanding these key indicators allows you to identify problems early and optimize your processes for maximum revenue capture. Regular monitoring ensures sustained financial success.

Here’s what successful implementation looks like:

| Metric | Target | Notes |

| Monthly Claims | 120 | Average volume |

| Clean Claim Rate | 93%+ | Industry benchmark |

| Revenue Per Claim | $38 | Average reimbursement |

| Monthly Revenue | $4,560 | Potential impact |

10. Action Steps: CPT 98967 Implementation

Successful implementation of CPT 98967 billing requires a structured approach. This actionable roadmap guides you through the essential steps, from initial planning to full implementation.

Following these steps ensures a smooth transition and optimal results:

| Step | What to Do |

| Audit Processes | Check documentation quality |

| Review claim denials | |

| Test staff knowledge | |

| Update Systems | Adjust EHR templates |

| Add time-tracking tools | |

| Set up reminders/alerts | |

| Train Staff | Teach coding requirements |

| Explain documentation rules | |

| Show how to track time |

Conclusion

Mastering CPT code 98967 brings substantial benefits to your practice’s revenue cycle. Focus on documentation accuracy, staff training, and consistent monitoring to optimize reimbursement rates. Remember: clean claims start with proper documentation and end with regular audits.

“Don’t let overlooked opportunities cost your practice. Start optimizing your telehealth billing today and watch your revenue soar! 📈 Ready to make every minute count? Contact MCB Collects for expert administrative solutions tailored to your needs.”