Executive Summary

98966 CPT Code enables billing for 5-10 minute telephone assessments by non-physician staff, averaging $14-$25 per call. Proper implementation can increase practice revenue by $3,200 monthly through structured documentation and compliant billing processes.

Introduction:

Managing telephone assessments effectively can significantly impact your practice’s revenue.

This guide provides a comprehensive roadmap for implementing CPT code 98966, covering eligibility criteria, documentation requirements, reimbursement strategies, and common pitfalls.

Whether you’re starting fresh or optimizing existing processes, you’ll find actionable insights to enhance your billing practices while maintaining compliance.

1- Understanding the Basics of CPT Code 98966:

Medical providers often struggle with determining which phone interactions qualify for billing under CPT code 98966.

Understanding the fundamental requirements is important because this code specifically targets assessment and management services provided by non-physician healthcare practitioners.

Unlike traditional face-to-face visits, these telephone interactions must meet strict criteria regarding duration, initiation, and clinical content.

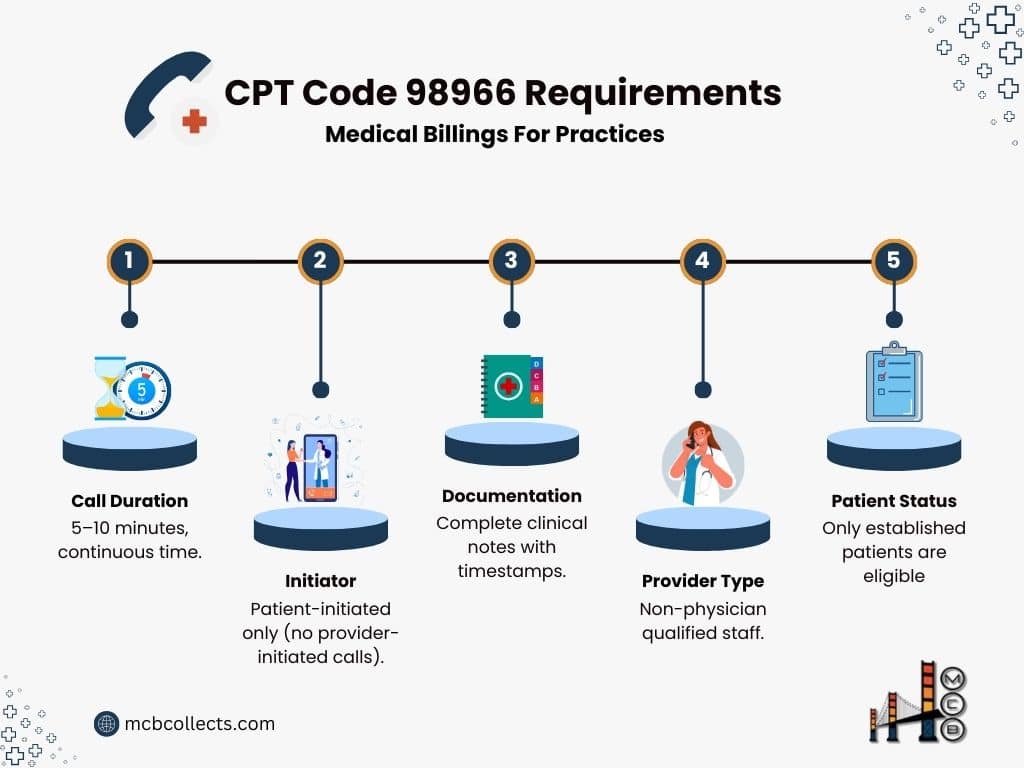

The requirements outlined in the following table serve as your foundation for compliant billing practices:

Core CPT Code 98966 Requirements Table:

| Requirement | Description | Important Notes |

| Call Duration | 5-10 minutes | Must be continuous time |

| Initiator | Patient-initiated only | Cannot be provider-initiated |

| Documentation | Complete clinical notes | Must include timestamps |

| Provider Type | Non-physician qualified staff | See eligible provider list |

| Patient Status | Must be established | New patients not eligible |

2- Eligible Healthcare Providers For CPT Code 98966

Proper credentialing and state licensure play a key role in determining which healthcare professionals can bill using CPT code 98966.

The complexity lies in understanding that while many providers may deliver similar services, billing privileges vary based on state regulations, payer policies, and supervision requirements. This variation creates a matrix of eligibility that must be carefully navigated to ensure compliant billing practices

Provider Qualification Matrix:

| Provider Type | Eligibility | Billing Requirements | Additional Notes |

| Clinical Psychologists | Yes | Independent license required | Can’t bill with E/M codes |

| Physical Therapists | Yes | State license required | Direct supervision needed |

| Occupational Therapists | Yes | State license required | Direct supervision needed |

| Speech Pathologists | Yes | State license required | Independent billing allowed |

| Licensed Social Workers | Yes | State clinical license | Varies by state |

| Registered Dietitians | Yes | State registration | Check payer policies |

| Nurse Practitioners | Conditional | When not billing incident-to | Check state scope laws |

3- Reimbursement Structure for CPT Code 98966

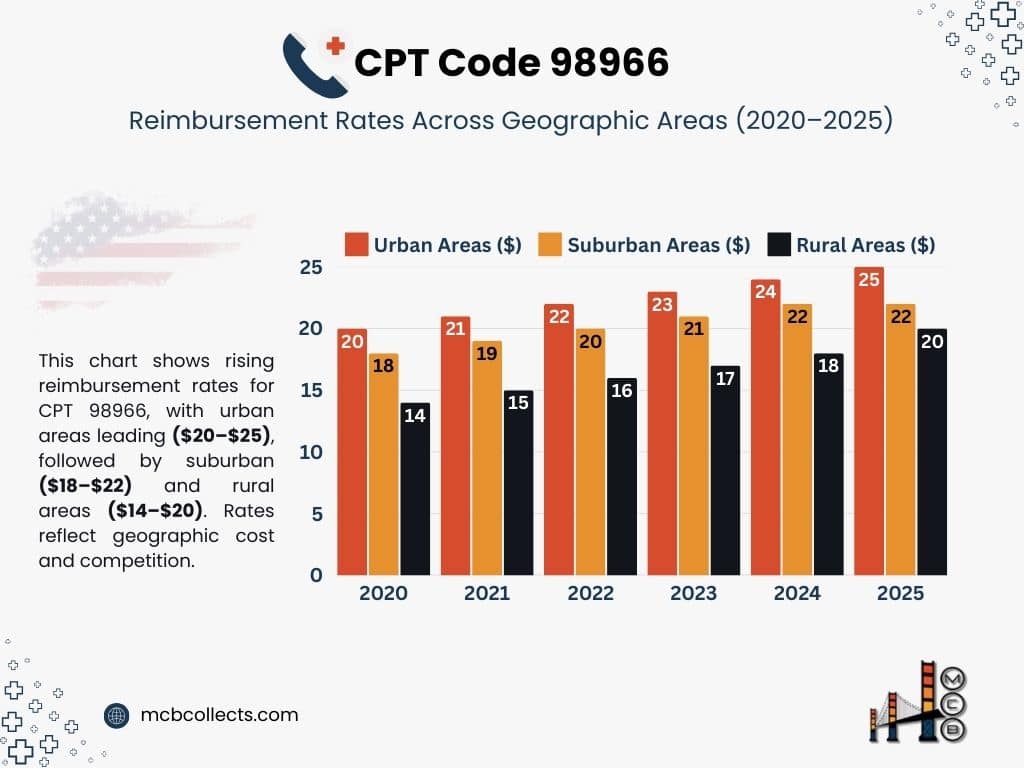

Understanding regional variations in reimbursement rates helps practices set realistic revenue expectations and optimize their billing strategies.

These rates aren’t arbitrary; they reflect local market conditions, cost of living adjustments, and the competitive landscape of healthcare services in different geographic areas.

Smart practices use this information to make informed decisions about staffing and resource allocation.

2025 Regional Rate Comparison for Current Procedural Terminology (CPT®) Code 98966:

| Geographic Area | Average Rate | Range | Factors Affecting Rate |

| Urban Centers | $21.50 | $18-25 | Higher operating costs |

| Suburban Areas | $19.00 | $16-22 | Medium competition |

| Rural Areas | $17.00 | $14-20 | Lower overhead costs |

4- Documentation Requirements

Proper documentation serves as the cornerstone of successful reimbursement and compliance for telephone-based services.

Think of your documentation as telling a complete story of the patient interaction; one that clearly justifies the medical necessity of the service and demonstrates the value provided.

Without robust documentation, even perfectly delivered services may face denial or require time-consuming appeals.

Essential Documentation Elements:

| Element | Required Content | Example |

| Time Tracking | Start/End timestamps | “9:15 AM – 9:23 AM” |

| Chief Complaint | Patient’s stated issue | “Increased post-op pain” |

| Assessment | Clinical evaluation | “Pain level 6/10, localized” |

| Plan | Clinical recommendations | “Modified exercise protocol” |

| Consent | Patient agreement | “Verbal consent obtained” |

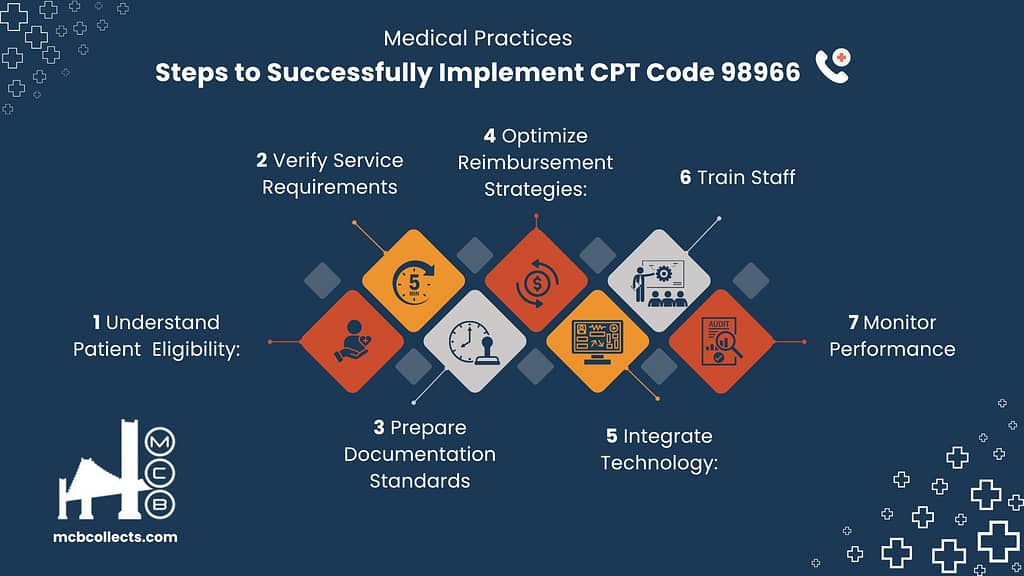

5- Implementation Strategy For Medical Billing Codes

Implementing a new billing code requires careful planning and systematic execution across your entire practice. Success depends on creating a structured approach that considers all stakeholders: from front-desk staff to clinicians to billing specialists.

Many practices fail to capture revenue not because they don’t provide qualifying services, but because they lack a comprehensive implementation strategy.

Practice Integration Timeline:

| Phase | Duration | Key Activities | Expected Outcomes |

| Planning | 2 weeks | Template creation, staff training | Ready for implementation |

| Pilot | 1 month | Limited rollout, testing | Process refinement |

| Full Implementation | 1 month | Practice-wide adoption | Full integration |

| Optimization | Ongoing | Regular audits, updates | Maximized returns |

6- Technology Integration for Medical Billing Codes

Modern medical practices rely heavily on technology to facilitate their billing processes and guarantee compliance.

The right technological infrastructure can automate many aspects of CPT code 98966 billing, reducing errors and improving efficiency.

However, choosing and integrating these systems requires careful consideration of your practice’s exact needs and workflows.

Required Systems Matrix:

| System Type | Purpose | Essential Features | Cost Range |

| EHR Templates | Documentation | Auto-timestamping, templates | Included in EHR |

| Time Tracking | Compliance | Automatic tracking | $0-50/month |

| Billing Software | Claims submission | Code verification | $100-300/month |

| Audit Tools | Compliance | Random sampling | $50-200/month |

7- Common Pitfalls and Solutions Implementing Billing Codes in Medical Practices:

Even experienced medical practices can stumble when implementing new billing codes. Being aware of common mistakes helps you proactively address potential issues before they impact your revenue cycle.

Most billing errors stem from simple oversights that can be prevented through proper training and systematic verification processes.

Medical Billing Error Prevention Guide:

| Common Error | Impact | Prevention Strategy | Resolution |

| Missing Time Documentation | Claim denial | Automated timestamps | Regular audits |

| Incorrect Provider | Payment delay | Staff training | Credential verification |

| Bundling Errors | Reduced payment | Clear guidelines | Claims review |

| Poor Documentation | Audit risk | Templates | Regular training |

Real Case Studies by Medical Claims Billing:

“See the real impact of MCB‘s solutions with our client case studies! These real-world examples demonstrate how we’ve empowered healthcare providers across a diverse range of specialties to navigate the complexities of medical billing.”

8- Financial Impact Analysis

Understanding the potential financial impact of implementing CPT code 98966 helps practices make informed decisions about resource allocation and staff training.

The revenue opportunity varies significantly based on practice size, patient demographics, and operational efficiency. Smart practices use this analysis to set realistic goals and monitor their progress toward optimal implementation.

Revenue Projection Table:

| Practice Size | Monthly Calls | Average Revenue | Annual Potential |

| Small (1-3 providers) | 100-150 | $1,500-2,250 | $18,000-27,000 |

| Medium (4-6 providers) | 200-300 | $3,000-4,500 | $36,000-54,000 |

| Large (7+ providers) | 400+ | $6,000+ | $72,000+ |

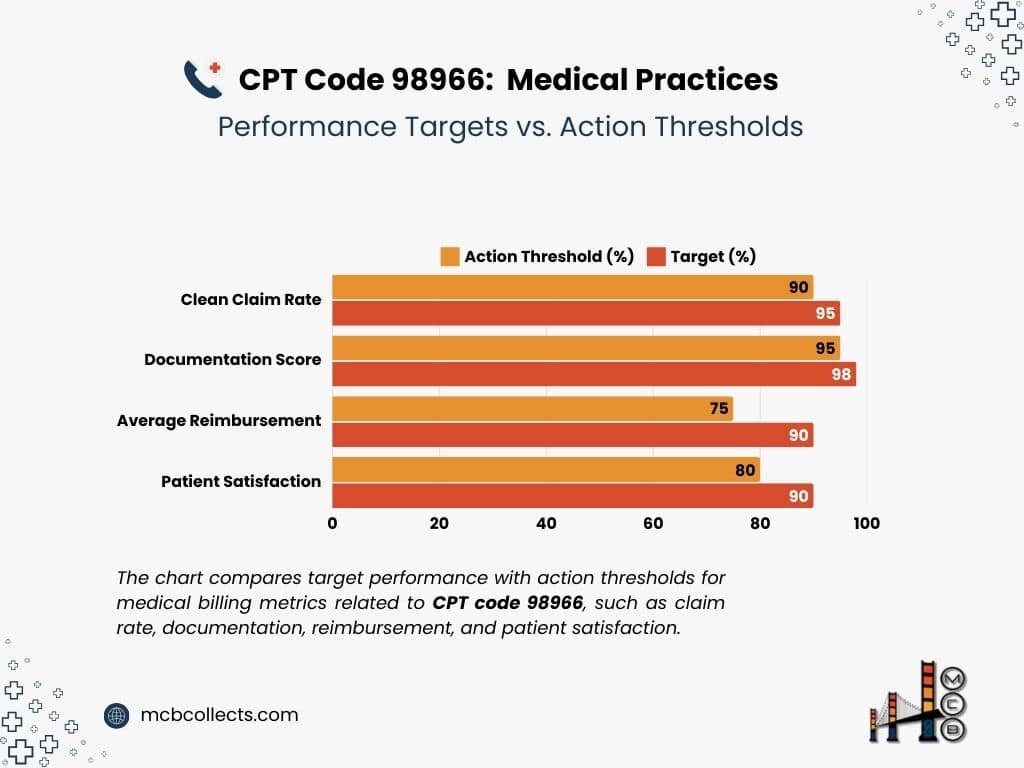

9- Performance Metrics

These key performance indicators (KPIs) are crucial benchmarks to evaluate the success of CPT code 98966 implementation.

They provide actionable insights into areas needing improvement and help ensure that the practice is maximizing revenue while adhering to compliance standards.

Consistent monitoring allows for timely adjustments to protocols and processes, preventing potential financial losses or compliance issues.

Key Performance Indicators:

| Metric | Target | Monitoring Frequency | Action Threshold |

| Clean Claim Rate | >95% | Weekly | <90% |

| Average Reimbursement | >$18 | Monthly | <$15 |

| Documentation Score | >98% | Monthly | <95% |

| Patient Satisfaction | >4.5/5 | Quarterly | <4.0 |

10- Future Considerations

Regularly tracking these metrics allows the practice to not only identify problems but also to pinpoint areas of success.

For example, a consistently high clean claim rate demonstrates the effectiveness of billing processes, while consistently high patient satisfaction scores reflect positive patient experiences with telephone-based services.

By using data to guide their decision-making, practices can allow for their CPT code 98966 implementation to be both effective & efficient.

2025 Projected Changes:

| Area | Current State | Expected Change | Impact |

| Reimbursement Rates | $14-25 | +5-10% increase | Revenue growth |

| Documentation | Basic requirements | Enhanced requirements | More detailed notes |

| Technology | Optional | Required integration | Investment needed |

| Coverage | Limited | Expanded services | More opportunities |

* Please note that these are just estimated, it’s advisable always to check with your regulators.

Conclusion

This comprehensive approach to implementing CPT code 98966 can significantly impact your practice’s revenue while maintaining compliance and quality care. Regular monitoring and updates to your processes will ensure continued success.

Take Charge of Your Practice’s Financial Health with MCB

At Medical Claims Billing (MCB), we are passionate about empowering healthcare providers to achieve financial success.

Driven by a commitment to exceptional service, continuous improvement, and a deep understanding of the healthcare landscape, we have a proven track record of delivering positive results for healthcare practices, streamlining their billing processes, maximizing revenue, and reducing administrative burdens.

Our team of experienced professionals combines industry expertise, cutting-edge technology, and a tailored approach to deliver tangible results for our clients.

- Schedule a Free Consultation: Connect with our expert team to discuss your specific needs and discover how MCB’s tailored solutions can help you achieve your revenue cycle goals.

- Explore Our Service Offerings: Dive deeper into the comprehensive range of services MCB provides, from revenue cycle management and denial management to compliance support and patient payment solutions.

Contact Us for Immediate Assistance: Facing an urgent billing challenge? Our dedicated team is here to provide swift support and guidance.